Today’s insurance agencies rely on an average of 5.7 to 11.9 different technology platforms for day-to-day operations, depending on their total revenue. For large-scale carriers managing multiple agencies and their downstream producers, it’s likely that number is even higher. While this level of digital innovation represents a positive change in the insurance industry’s ability to offer modern experiences to its consumers and efficient workflows to its employees, cultivating a more robust tech stack doesn’t come without challenges. ...

By Lewis Nibbelin, Contributing Writer, Triple-I ...

“When we, as LGBTQ+ adults, make the decision to get into a relationship and start a family, it’s not always with the support of our own family.” That is a poignant statement that will resonate with a lot of people. ...

Get a free, customized quote today! ...

The answer: it depends. While many believe that insurance is a “set-and-forget” type of investment, that isn’t always the case. Depending on your area of practice, location, and more uncontrollable factors, your insurance coverage may go “out of date” sooner than you think. That is, if you aren’t setting up a proactive legal malpractice insurance renewal. ...

The annual Accenture Tech Vision report is in its 25th year and continues to be a huge source of insight for our technological future. This year, AI: A Declaration of autonomy features four key trends that are set to upend the tech playing field: The Binary Big Bang, Your Face in the Future, When LLMs Get Their Bodies, and The New Learning Loop. “The New Learning Loop” is a particularly compelling trend to me for the insurance industry. This trend explores how the integration of AI can create a virtuous cycle of learning, leading, and co-creating, ultimately driving trust, adoption, and innovation. ...

This post is part of a series sponsored by AgentSync. ...

Artificial intelligence is everywhere these days, affecting the way that industries around the world operate. And the legal field is no different. ...

Fueled by rapid technological advancements, demographic changes and shifting consumer expectations, the Life & Annuity industry is set for several transformative changes in 2025. Swiss Re forecasts average global real premium growth of 2.6% in 2025 and 2026, with life insurance projected to expand globally by 3% annually— more than twice the pace of the past decade. In this evolving landscape, staying ahead of the curve is not just a competitive advantage; it’s a necessity for survival. ...

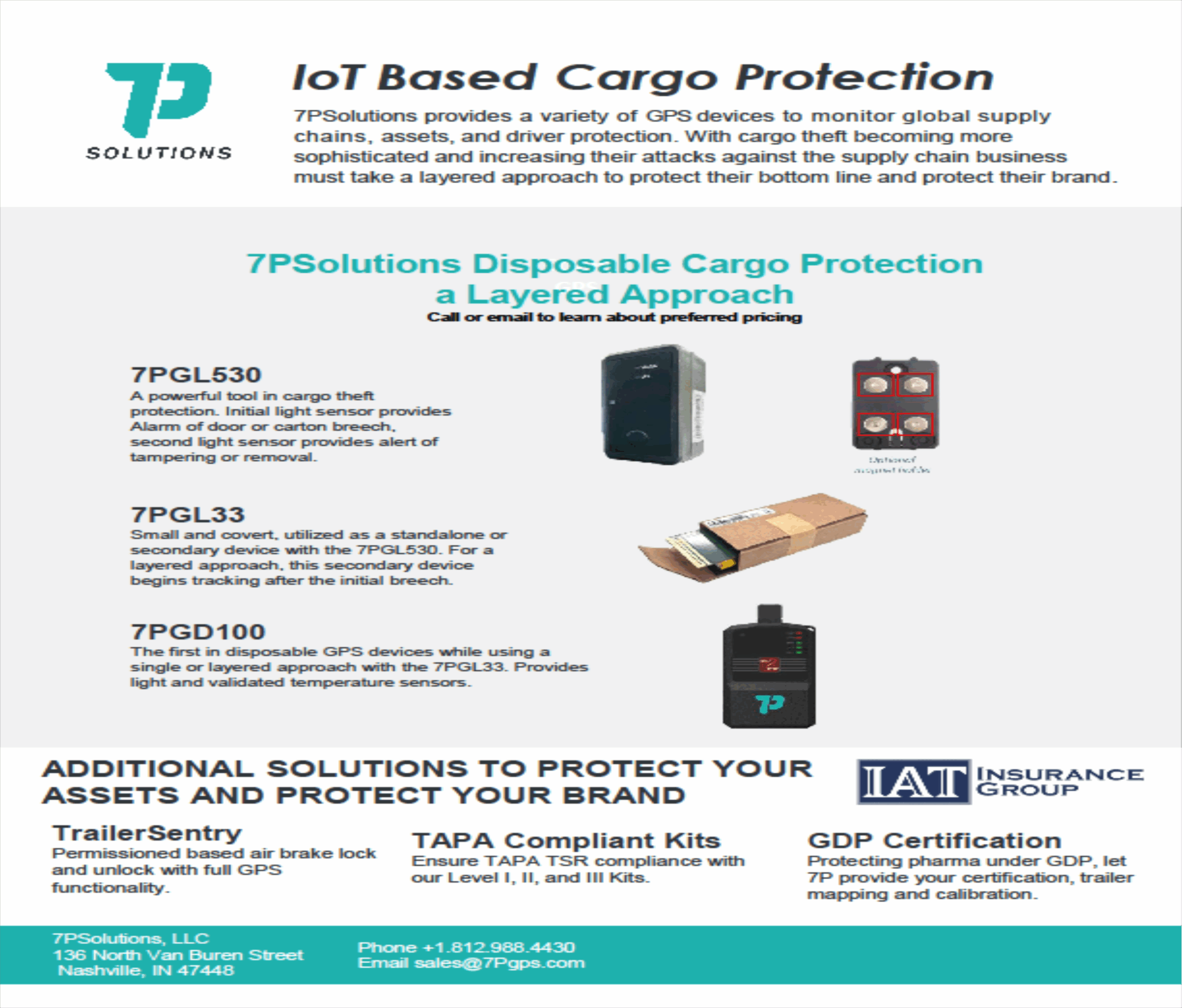

This post is part of a series sponsored by IAT Insurance Group. ...